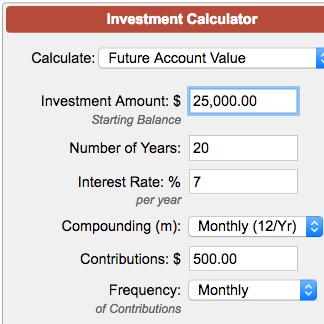

SIP investments are generally for a fixed period of 1 year 3 years or 5 years. In case the holding period is more than one month then one can use the below mentioned formula to calculate compound annual growth rate.

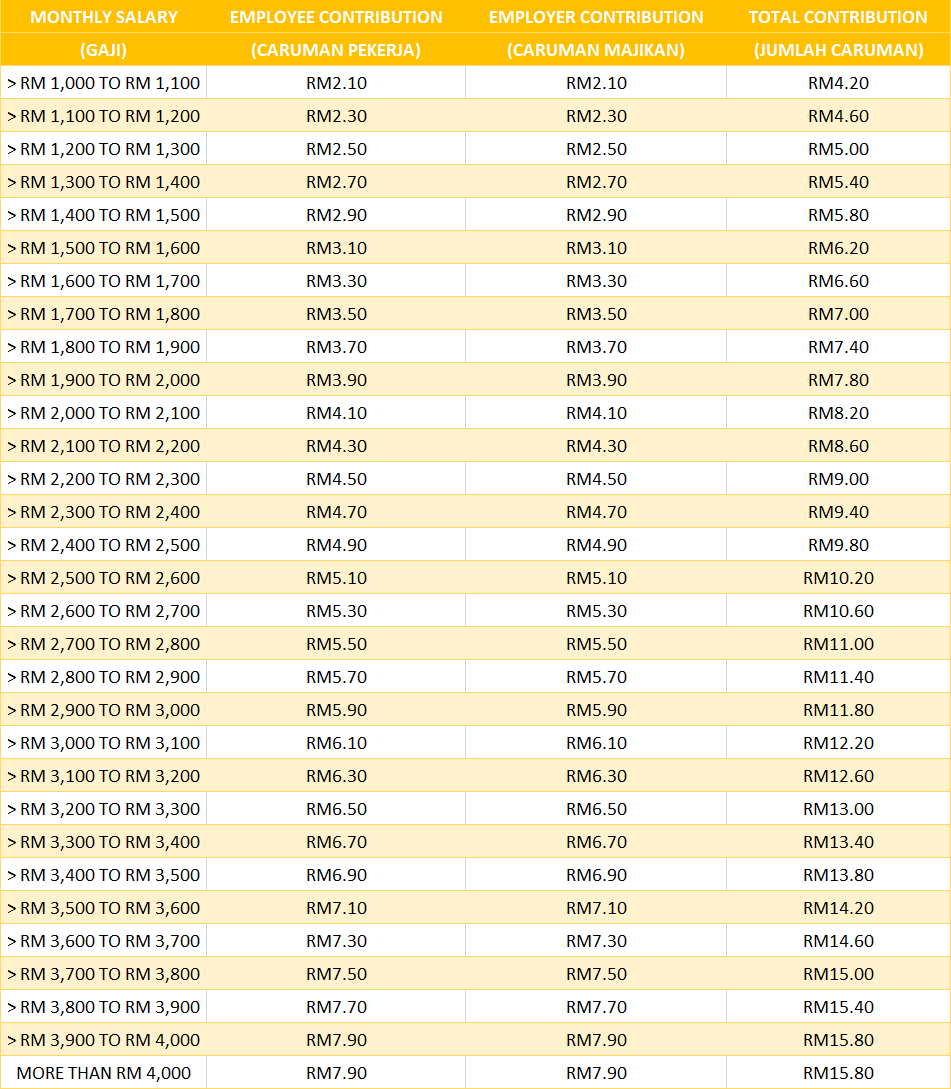

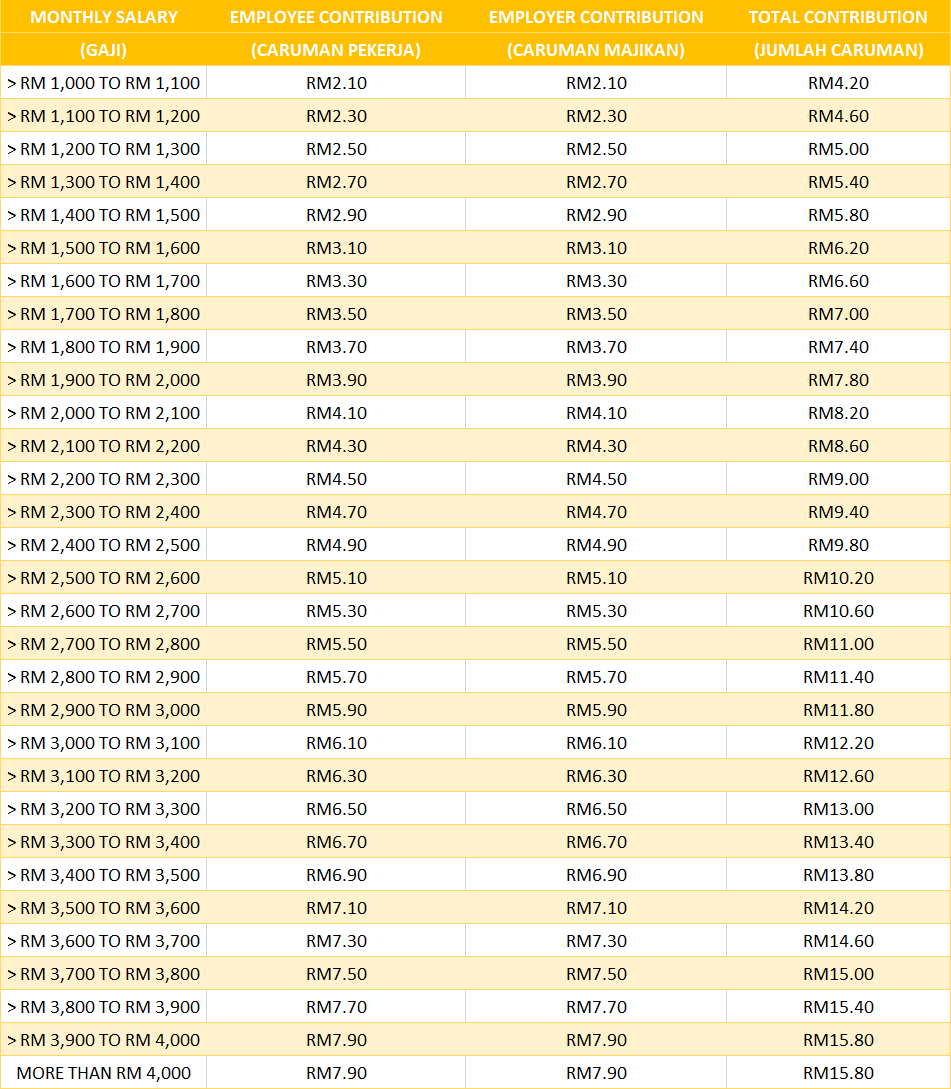

According to EIS contribution table contribution rates are specified in the second annex and are governed by the.

. Compound Annual Growth Rate can be quickly computed using this formula. Contributions to the Employment Insurance System EIS are set at 04 of the employees assumed monthly salary. For example higher tax-payers earn up to 45 higher tax relief than basic rate tax-payers.

Wages Above RM 2900. Wages between RM 2800 and RM 2900. According to the EIS contribution table 02 will be paid by the employer and 02 will be cut from the employees monthly wages.

P is the amount you invest at regular intervals. N is the number of payments you have made. In this formula.

Employment Insurance EIS contributions are set at 04 of an employees estimated monthly wage. Likewise you can make a bigger contribution to your SIP account when you receive a bonus or an additional income. Kadar caruman sip 2022 jadual caruman sip perkeso 2022 jadual caruman perkeso eis 2022 kadar caruman sip 2022 tarikh bayaran caruman sip.

Step Up SIP is a facility wherein an investor who has enrolled for SIP has an option to increase the amount of the SIP Installment by a fixed amount at pre-defined intervals. To help maximise your savings potential HMRC will also contribute 20 of your contributions if you are a basic rate taxpayer. I is the periodic rate of interest.

You get a rough estimate on the maturity amount for any monthly SIP based on a projected annual return rate. Ending Valuebeginning-value 12 number of months 1100. In the above formula.

Interest on late payment of contributions will be imposed at a rate of 6 per annum for each day of contributions not paid within the stipulated period. For monthly salarywages gaji more than RM1000 and up to RM4000 you may refer to this infographic of the EIS Contribution Table Kadar Caruman SIP. The contribution rate for employment insurance system eis is 02 for the employer and 02 for employee based on the employees monthly.

Lets say you pay the basic rate of tax and get 800 from your. This calculator helps you calculate the wealth gain and expected returns for your monthly SIP investment. M P 1 in 1 i 1 i.

Your equity fund SIP redemptions are taxable only if your gains from equities exceed Rs 1 lakh in a year. EIS Contribution Table Download. About SIP calculator online.

Share Incentive Plans SIPs If you get shares through a Share Incentive Plan SIP and keep them in the plan for 5 years you will not pay Income Tax or National Insurance on their value. Employers need to make a 02 contribution for each of their employees. If you find yourself in doubt about anything pertaining to the SOCSO fun do not hesitate to contact one of our friendly customer service agents.

This tool not only provides you SIP return. P is the amount you invest at regular intervals. A SIP plan calculator works on the following formula.

Youll want to take this into account when calculating your lifetime and annual SIPP allowances. It gets a little more complicated the higher your earnings are. Contribution By Employer Only.

A SIP mutual fund is referred to as Perpetual SIP if you do not mention the end date in the mandate date. The current interest rate of NPS is 8-10 on the contribution made. Maximum SIPP contributions for earnings over 150000 per year.

Ending- value beginning- value 1number of years-1100. They will be more than happy to help you out and the best part is all advising is free of charge. I is the periodic rate of interest.

When wages exceed RM30 but not RM50. 02 will be paid by the employer while 02 will be deducted from the employees monthly salary. Ensuring higher rates.

Perkeso jadual caruman sistem insuran pekerjaan sip. Contribution rates are set out in the Second Schedule and subject to the rules in Section 18 of the Employment Insurance System Act. M is the amount you receive upon maturity.

Wages up to RM30. They are higher for non. M is the amount you receive on maturity.

Since the amount is invested on regular intervals usually on monthly basis it also reduces the impact of market volatility. M P 1 in 1 i 1 i. While your employers contributions are gross meaning tax is deducted from their SIPP contributions your SIPP contributions are net making them tax-free.

Our SIP Calculator uses the following formula. N is the number of payments you have made so far. To get the SIP return for your investment enter all of the values in the calculator input area and hit the calculate button.

Tax rates are different for equity and non-equity funds.

Monthly Contribution To Sip Up In May By Rs 423 Crore Says Amfi Report

Who Benefits From Proposed Changes To 401 K Catch Up Contributions

After Tax 401 K Contributions Retirement Benefits Fidelity

Bispoint Group Of Accountants Who Should Contribute Pcb Epf Socso Eis What Is The Rate Of Contribution How To Calculate Pcb Http Calcpcb Hasil Gov My Index Php Lang Eng Socso Contribution Table Https Www Perkeso Gov My Index Php

Should You Buy Sukanya Samriddhi Yojana Mutuals Funds Economic Times Article Writing

Labor Day Bogo Jamba Juice Jumba Juice Smoothies

Income Tax Deductions List Financial Planning Tax Deductions List Tax Deductions

Eis Perkeso Eis Contribution Table Eis Table 2021

Explained All About How Your Epf Contributions Above Rs 2 5 Lakh Would Be Taxed

Simple Ira Contribution Limits For 2022 Kiplinger

Life Insurance Or Tax Saving Mutual Funds In 2021 Mutuals Funds Mutual Equity Market

Roth 401k Roth Vs Traditional 401k Fidelity

After Tax 401 K Contributions Retirement Benefits Fidelity

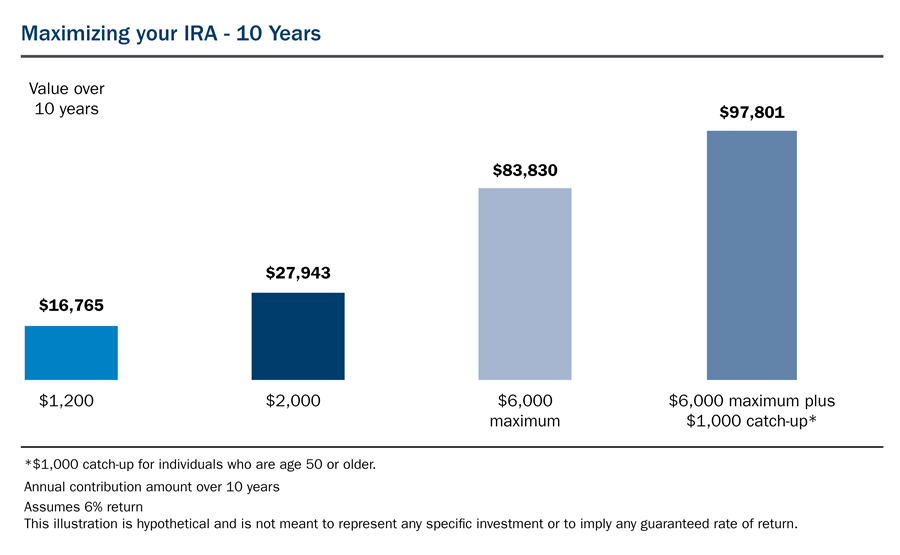

Contributing To Your Ira Start Early Know Your Limits Fidelity

Vanguard Roth Contributions Another Benefit Of Your Retirement Plan

Inventing The Ipod How Big Risks And Crazy Ideas Paid Off For Apple In 2022 Ipod Apple Inventions

Maximize Retirement Contributions Ameriprise Financial

Value Contribution Mind Map Download Scientific Diagram